Tally Yellow Belt Question

This is tally Practice question for preparing Yellow Belt also Project and case study of Tally , this cover

Company Creation, Stock items, Bill of Material, Manufacturing Journal convert Raw Materials to Finished Goods, Creating Price List for Retailers and Distributer with Slabs Discount, Deducting TDS ,Pay TDS to Income Tax Dept, Using Cost Center to Analyze Salesmen wise Productivity, How to sell goods outside Country ,Multicurrency Set Conversion Rate of other Currency, Payment , Receipt ,Sale Voucher, Activation of Cheque Book in Bank

- The company creation

| Company Name | Mr. White Champion Industries | |

| Address | No 319/2, Waghere Colony, Pimpri Gaon, Pune | |

| Country | India | |

| State | Maharashtra | |

| Pin code | 411017 | |

| e-mail ID | accounts@whitechampion.com | |

| Website | www.whitechampion.com | |

| The financial year begins from | 01-04-2019 | |

| Books beginning from | 01-04-2019 |

- Statutory Configuration

GST configuration

| State | Maharashtra | |

| Registration type | Regular | |

| GSTIN /UIN | 27AACD3069K1ZJ | |

| Applicable from | 01-04-2019 | |

| Periodicity of GSTR 1 | Monthly | |

| e-way bill Applicable | Yes | |

| Set /Alter GST RATE DETEAILS | Yes | |

| HSN Description | Erasers | |

| Taxability | Taxable | |

| Integrated | 5% |

TDS Configuration

TAN NO : DELA02603G

Set ignore IT exemption limit for TDS deduction = Yes

- Item Master Creation

| Stock item | Stock Group | Unit of measure | GST | HSN |

| Rubber | Raw materials | Kg of 1000 gms (with 3 decimals) | 5% | 4001 |

| Pigments | Raw materials | Kg of 1000 gms (with 3 decimals) | 18% | 3212 |

| Sulphur | Raw materials | Kg of 1000 gms (with 3 decimals) | 5% | 2503 |

| Mr. white eraser-1.5 lnch | Finished good | NOS | 5% | 4016 |

| Mr. white eraser-2.5 lnch | Finished good | NOS | 5% | 4016 |

- Bills of Materials Creation

| Finished goods/raw materials | Mr. white eraser-1.5 lnch (to manufacture 1 No) | Mr. white eraser-2.5 lnch (to manufacture 1 No) |

| BOM Name | BOM 1 | BOM 1 |

| RUBBER | 15 GRAMS | 25 GRAMS |

| PIGMENTS | 3 GRAMS | 5 GRAMS |

| SULPHUR | 2 GRAMS | 3 GRAMS |

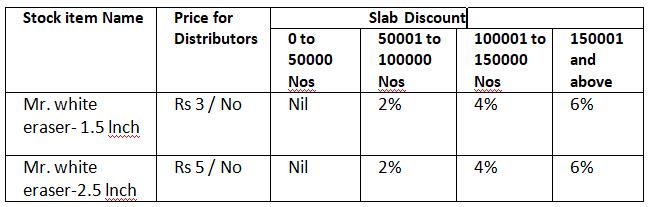

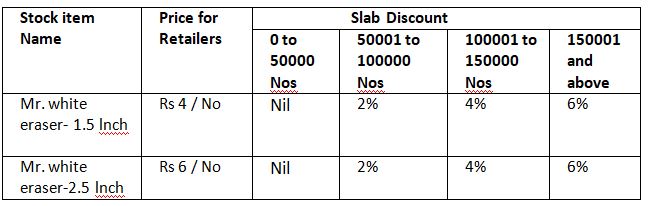

- Price List Creation

The company offers a different price list for a different type of customers and addition to that gives a discount on bulk

buying.

- Salesman – wise Turnover and Commission , Department- wise expenses tracking

The company has sales managers for different regions, each sale is tracked to salesman and every month 1 % commission is paid on turnover achieved by each of them further, they want to allocate expenses to department to analyze spending pattern. The sales managers working for the company are – Sagar Gore, Ramesh Pendse , Alex Mathew.

- TDS Nature of Payment Creation

| Nature of payment | Additional details |

| Fees for professional or Technical Services | Rate = 10%, exemption limit= Nil |

- Budgets on “indirect expenses”

The company allocated budget amount of Rs.25,00,000 on ‘Indirect Expenses’ as Expenses Budget. It is set on ‘Closing Balances’ and for the whole financial year i.e, from 1st apr 2019 to 31st march 2020

- Account Master Creation

| Ledgers | Group Under | Additional Details |

| Plant and machinery A/C | Fixed asset | Is GST applicable = yes, GST rate=18 % integrated tax, nature of transaction=interstate purchase taxable ,nature of goods = capital goods, |

| Input CGST | Current assets | Type of duty = GST/ Central tax Note: in ledger creation screen press F12 (configure) and set t ledgers to behave as duties & taxes = yes ,then you can enable GST for ledger crated under current assets group |

| Input SGST | Current assets | Type of duty= GST/State tax |

| Input IGST | Current assets | Type of duty= GST /integrated tax |

| HDFC Bank A/c | bank | Account number= 151000987768222,IFC Code= HDFC0000039 Branch = Pune – Boat Club Activate cheque book – 000001 to 000100 |

| St. George Rubber Traders | Sundry Creditors | Maintain balance bill by bill=Yes State = Kerala, PIN code- 686578 GSTIN = 32AABCT3518Q1Z5 |

| Polymer Colour Company | Sundry Creditors | Maintain balance bill by bill = Yes State = Maharastra,PIN code- 411014, GSTN = 27AAACB5343E1Z1 |

| C S industries | Sundry Creditors | Maintain balance bill by bill=Yes State= Odisha, PIN code- 751007 GSTIN=24ALOPR2210G1ZB |

| MAKS distributors | Sundry Debtors | Price list= Distributors Maintain balance bill by bill=Yes Credit Period = 30 days Interest Calculation= Yes Set- 20% per Calendar Year State=Maharashtra, pin code 411002 GSTIN= 27AAACB5343E1Z1 |

| Orbit Solutions | Sundry Debtors | Price list= Retailers Maintain balance bill by bill=Yes Credit Period = 30 days Interest Calculation= Yes Set- 20% per Calendar Year State=Maharashtra, PIN Code 411001 GSTIN= 27AAATI1446A1Z7 |

| Office Mate Ghana Limited | Sundry Debtors | Maintain balance bill by bill=yes country= Ghana Price List =Not Applicable The currency of the ledger- Rs. |

| Secured Loan A/c | Secured Loans | Interest calculation =yes Set -14% per Calendar year |

| Joshi & Kulkarni | Sundry Creditors | Deductee Type= Partnership Firm PAN= AABCJ8888G |

- BUSSINESS TRANSACTIONS

Record the following transactions for Mr. White Champion Industries:

- On 1-Apr-2019 ,MR. Vimal Khelkar introduced capital Rs.30,00,000 and deposited into HDFC bank A/c

- On 3-Apr-2019 , the company purchased Plant & Machinery from C.S. Industries for manufacturing Erasers for Rs. 16,00,000 + 18% IGST, Bill No. CS -005

- On 5-Apr-2019, RS. 10,00,000 paid through HDFC BANK to C.S. Industries via chq no 000001 against Bill No CS- 005

- On 8-Apr-2019 , took a secured loan of 10,000,00 and deposited in HDFC Bank A/C @ 14% per the calendar year , interest payable every month.

- On 10-Apr-2019, the company purchased the following raw materials from Polymer Color Company via invoice no. 658/2019-20, all price are excluding GST.

| Stock Item | Quantity | Rate |

| Pigments | 5000 kgs | RS. 75/ KG |

| Sulphur | 5000 kgs | Rs. 20/kg |

- On 10-Apr-2019, the company purchased the following raw materials from St. George Rubber Traders via Invoice no. 86 All prices are excluding GST.

| Stock item | Quantity | Rate |

| Rubber | 20000 Kgs | Rs. 101.60/kg |

- On 20-Apr-2019 Mr. White Champion Industries manufactured finished good as per the table below

| Stock item | Quantity | Batch No |

| Mr. white eraser- 1.5 lnch | 4,00,000 Nos | Batch 01 |

| Mr. white eraser-2.5 lnch | 2,00,000 Nos | Batch 01 |

- On 25-Apr-2019, received an order No. 112 from MARKS Distributors all price list rates are exclusive of GST , add GST wherever applicable.

Note : enable F11 feature ‘Use separate discount column in invoice= Yes’ under inventory feature to calculate discount on stock item in invoice.

| Stock item | Quantity | Batch No | Rate |

| Mr. White Eraser- 1.5 lnch | 1,25,000 NOS | Batch 01 | As per price list |

| Mr. White Eraser-2.5 lnch | 75,000 NOS | Batch 01 | As per price list |

- On 27-Apr-2019 , delivered all the materials against Order No. 112 to MARKS Distributors.

Raised Sales Invoice on the same day , the company wants to have Invoice Number format aqs 1/2019-20. Allocate the value to sales manager Sager Gore.

Add e – way bill details only in Sales Invoice

| E-way bill no | 181003355475 |

| Distance | 19 kms |

| Vehicale No | MG02 B-8622 |

| PIN | 411002 |

- On 28-Apr-2019 , received an order no. 106 from Orbit Solutions . Price List rates are exclusive of GST , add GST ledgers wherever applicable. Allocate this order to Sales Manager Ramesh Pendse

| Stock item | Quantity | Batch No | Rate |

| Mr. white eraser- 1.5 lnch | 85,000 NOS | Batch 01 | As per price list |

| Mr. white eraser-2.5 lnch | 25,000 NOS | Batch 01 | As per price list |

- On 29-Apr-2019 , delivered below materials against Order No 106 to Orbit Solutions. Allocate this delivery note to Sales Manager Ramesh Pendse

| Stock item | Quantity | Batch No | Rate |

| Mr. white eraser- 1.5 lnch | 60,000 NOS | Batch 01 | As per price list |

| Mr. white eraser-2.5 lnch | 25,000 NOS | Batch 01 | As per price list |

| E-way bill no | 18100887887 |

| Distance | 18Kms |

| Vehicle No | MH-12 HK-1276 |

| PIN | 411001 |

- On 30-Apr-2019 paid Orbit Soultions Rs 100000 via Chq No 000002

- On 30-Apr-2019 ,booked 15,000 professional service fees to chartered accountants Joshi & Kulkarni , deducted TDS @ 10% as per the income tax act.

- On 01-may-2019 ,received 5,00,000 via chq no 121222 drawn on AXIS bank from MARKS Distributors against invoice no 1/2019-20 and deposited the same in HDFC bank

- On 02-May-2019, received 5,00,000 via Chq No 121222 frawn on AXIS Bank from MAKS Distributer against Invoice No 1/2019-20 and deposited the same in HDFC Bank

- On 05-may-2019, received an order no 475 from office mate Ghana Limited, Ghana allocate this order to sales manager Alex Mathew.

| Stock item | Quantity | Rate |

| Mr. white eraser- 1.5 lnch | 1,50,000 NOS | $ 0.07 |

| Mr. white eraser-2.5 lnch | 65,000 NOS | $ 0.12 |

Today’s conversion rate 1 $ = Rs 69

- On 05-may-2-19, paid TDS 1,500 via HDFC bank chq no 000004 to Income Tax Department

- On 10-may-1019 , delivered below materials against order no. 475 to Office Mate Ghana limited, Ghana

Raised export invoice as export invoice as ‘Export Exempt ‘ Goods for GST . this sale to sales Alex Mathew.

| Stock item | Quantity | Batch no | Rate |

| Mr. white eraser- 1.5 lnch | 1,50,000 NOS | Batch 01 | As Per Order Raised |

| Mr. white eraser-2.5 lnch | 65,000 NOS | Batch 01 | As Per Order Raised |

Today’s conversion rate 1 $ = Rs 69

| Export Invoice Details | |

| Shippng Bill No & Date | 785542 / 10-May-2019 |

| Pin code (pune) | INGRD6 |

| Mode | Ship |

| Distance | 150 kms |

| Bill of lading no | 18542587965 |

| Pin no | 400001 |

- On 20-May-2019 received $ 18,300 from Office Mate Ghana Limited, Ghana via swift transfer to HDFC against invoice no 2/2019-20

Today’s conversion rate 1 $ = Rs 70

- On 31-May-2019 office staff salaries of 99250 from HDFC bank A/c to employees via chq no 000005