A tool help you to manage & configure TDS easily and quickly

TDS Helper has been designed as per the new rules of TDS under section 194Q. As per the rules business having turnover more than 10 crore have to deduct TDS on purchase from parties with whom they have purchase goods more than fifty lakh.

Current Challenges

1. Mostly we enter GST number of supplier and leave the PAN field blank. With this new rules if PAN is not available in your master then it will deduct at higher rate. Hence updating PAN of supplier is big task for users.

2. Apply TDS to supplier master one by one, As there are many supplier so updating TDS details in each and every ledger with deductee type (Individual/HUF/Company) is very hard and time consuming task.

3. Finding list of parties with whom we have crossed 50 lakh transaction. Currently to find out this we have to go to individual ledgers and manually calculate the total of purchase is time consuming.

5. While doing transaction with Suppliers we have to select TDS classification in purchase Ledger and GST ledgers. Selection of TDS classification in each and every voucher is very repeated and difficult task for users and there are chances of mistakes.

6. Notification when Customer cross threshold limit will work when we alter past transaction of party with below threshold TDS classification

Source :https://tallysolutions.com/tally/tds-on-purchase-of-goods-under-section-194q/

Featureshttps://www.youtube.com/embed/sBvEV099snY?autoplay=0&mute=0&controls=1&loop=0&origin=https%3A%2F%2Fwww.welfareinfotech.com&playsinline=1&enablejsapi=1&widgetid=1

- Update Suppliers PAN in Bulk

- TDS Applicability to Supplier in Bulk

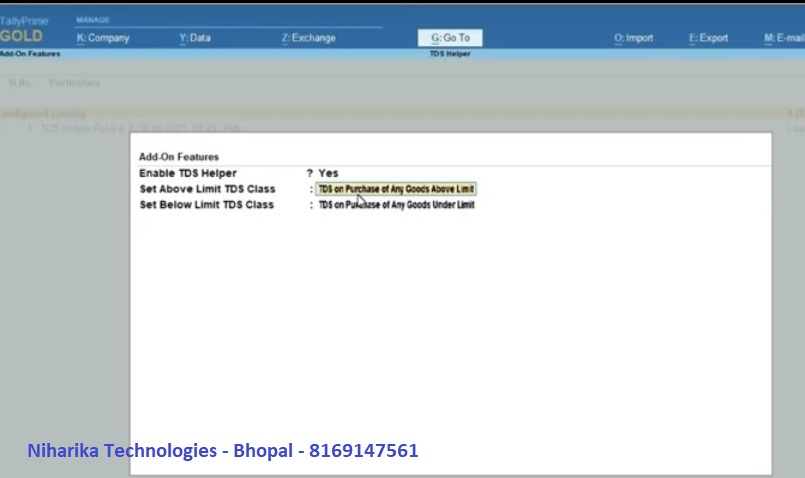

- Set above & under limit classification in bulk

- Supplier wise Turnover report Above 50L

- Supplier wise Payment report Above 50L

- Non PAN Party Validation in transaction

- Auto Set TDS Classification above & under in Voucher

- Party wise Turnover & Gross Payment in Voucher

- TDS notification if supplier exceed threshold

Benefits to Business

Update Bulk Supplier PAN at one shot

a. TDS Will calculate correctly

b. Time save from save time from updating PAN manually

c. Also helpful in other tax related reports & work.

Apply TDS to supplier at bulk & auto set Deductee type

a. Time save from applying TDS & deductee type on ledger one by one

b. Also helpful in other tax related reports & work.

Turnover and PAN display with validation at transaction

a. Saves time as we don’t have to go for ledger report for checking turnover

b. Validate at purchase entry if supplier crossed threshold help in charging correct TDS

c. Non PAN parties will mark in red color help you to correct your customer database properly

Auto Pick of TDS Classification in transaction

a. It saves more than a hour if we made more than 50 invoices in a day as user do not have to select TDS classification